Financial independence is frequently viewed as a numbers video game-- a matter of collecting properties, cutting expenses, and making critical financial investments. While these are definitely important factors, there's another, commonly forgot, component that plays just as significant a role: way of thinking. Your ideas, emotions, and routines surrounding money can either drive you towards monetary flexibility or hold you back from accomplishing it.

The Mindset Shift: From Scarcity to Abundance

Among the greatest challenges to monetary self-reliance is a shortage state of mind. This state of mind is rooted in the belief that resources are minimal which monetary safety is always contemporary of reach. Individuals with this point of view typically make fear-based financial choices, such as hoarding cash, preventing investment possibilities, or sensation anxious concerning every cost.

An abundance mindset, on the other hand, identifies that chances exist and that monetary success is not a zero-sum video game. Those who cultivate this expectation focus on development, long-term preparation, and making calculated choices that cause financial self-reliance. Shifting from deficiency to abundance calls for a mindful initiative to reframe financial ideas and welcome calculated threats that can enhance asset management in Tampa and beyond.

Psychological Intelligence and Financial Success

Cash is not just a logical subject; it is deeply psychological. Concern, greed, guilt, and enjoyment all play a role in how we handle our funds. People with high psychological intelligence have a tendency to make better financial decisions due to the fact that they know their feelings and do not let them dictate their monetary selections.

For instance, throughout durations of economic uncertainty, psychologically smart people remain calm, avoid panic-driven decisions, and adhere to their long-lasting economic strategies. By developing self-awareness and self-control, people can develop a financial plan that aligns with their goals and values, guaranteeing they make thoughtful selections pertaining to investments, tax planning in Tampa, and savings.

The Power of Financial Goals and Visualization

Achieving monetary freedom begins with establishing clear, realistic goals. Without a defined vision, it's easy to drift with monetary choices without instructions. An effective approach is visualization-- emotionally picturing the way of life you wish to produce and the steps needed to get there.

Successful individuals frequently imagine their monetary goals daily, reinforcing their commitment to saving, spending, and clever investing. This method assists line up daily actions with lasting desires, whether it's safeguarding life insurance in Tampa for future safety and security or tactically planning for retirement.

Conquering Fear and Taking Calculated Risks

Worry is one of the greatest obstacles to economic freedom. Concern of investing, concern of losing money, and fear of making the incorrect choice can all cause inactiveness. Nevertheless, financial development needs taking calculated risks. Recognizing threat does not imply blindly diving right into high-stakes investments but instead informing oneself, seeking advice, and making notified decisions.

Several economically independent individuals collaborate with wealth advisors in Tampa to help them browse these dangers and build self-confidence in their monetary techniques. They recognize that taking calculated steps-- such as diversifying financial investments and staying informed concerning market patterns-- can minimize threat while optimizing returns.

The Importance of Financial Habits

Attitude alone is insufficient-- habits form financial success. Daily, regular financial behaviors like budgeting, automated cost savings, and critical investing lay the groundwork for lasting monetary freedom. Little activities, repeated gradually, lead to considerable economic results.

Establishing solid financial routines calls for self-control yet additionally a shift in point of view. As opposed to seeing financial administration as limiting, view it as a tool that equips future liberty. Focusing on savings, investing sensibly, and keeping track of spending will slowly develop the riches required for economic freedom.

Aligning Money with Personal Values

One of the most fulfilling aspects of financial self-reliance is the capability to live life on your own terms. Money is not practically build-up; it's regarding using it in ways that align with your values and aspirations. Some people locate gratification in taking a trip, others in philanthropy, and some in safeguarding a heritage for their liked ones with life insurance in Tampa.

Aligning finances with individual worths produces a deeper sense of objective and contentment. When economic decisions are made based on what absolutely matters, cash ends up being a tool for boosting life instead of a source of tension.

The Role of Professional Guidance

While state of mind is important, having expert assistance can speed up the trip toward financial freedom. Dealing with official website specialists that specialize in asset management in Tampa can give important insights and methods tailored to specific goals. From estate preparation to investment methods, having actually a trusted expert guarantees that economic decisions straighten with long-term goals.

In a similar way, experts that specialize in tax planning in Tampa can assist maximize financial methods by decreasing tax problems and making the most of wide range conservation. This proactive method makes certain that even more of your hard-earned money works for you instead of being shed to unneeded taxation.

Keep Growing, Keep Learning

Accomplishing monetary freedom is not nearly getting to a number-- it's about continuous growth and adaptability. The monetary landscape progresses, therefore need to your expertise and approaches. Remaining educated, learning from experienced professionals, and refining financial habits will aid keep and increase economic self-reliance gradually.

Follow our blog for more insights on economic approaches, wealth-building pointers, and specialist recommendations. Remain tuned, stay inspired, and take control of your economic future!

Luke Perry Then & Now!

Luke Perry Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Sam Woods Then & Now!

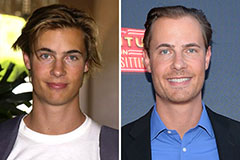

Sam Woods Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now!